(2022)

In 2022 , under the guidance of the Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era and Xi Jinping Thought on the Rule of Law, the Shanghai Financial Court (“Court”) has been putting the guiding principles of the 20th CPC National Congress into action by being committed to the fair and impartial administration of justice for all, supporting the national strategies and programs for the financial industry, and maximizing the function of financial adjudication in various finance-related civil, commercial, and administrative cases. Through these efforts, the Court has provided equal protection under the law to various financial entities, helped align the financial industry with the real economy, supported financial reform and innovation, prevented and mitigated financial risks, and provided a strong financial judicial support for the construction of Shanghai international financial center. This report is meant to provide a summary of the adjudication activities at the Court in 2022.

I. Court Cases

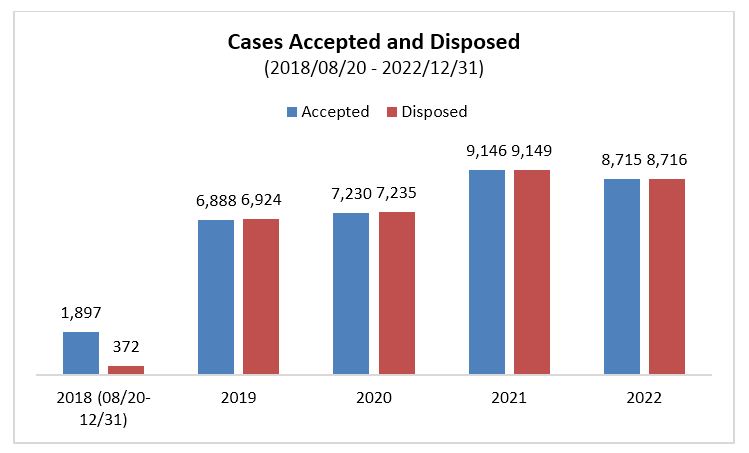

1. Caseload[i]

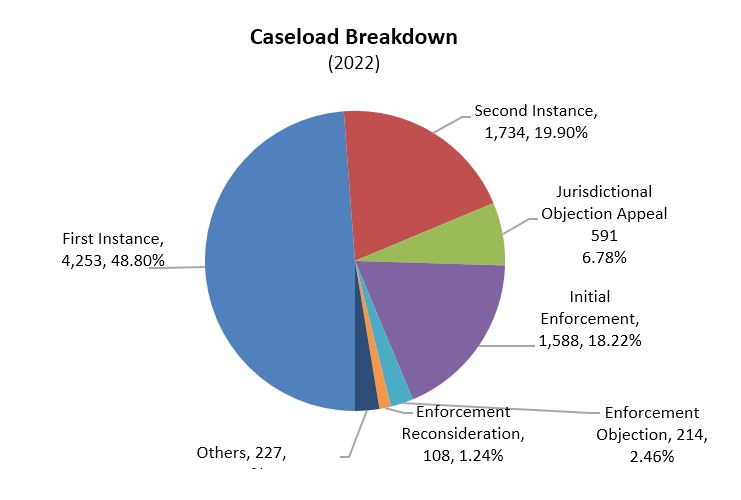

The Court accepted 8,715 financial cases in 2022, composed of 4,253 first-instance cases(excluding special procedure cases and third-party revocation of judgment cases), 1,734 second-instance cases , and 1,588 initial enforcement cases.

The Court disposed of 8,716 financial cases in 2022, consisting of 4,229 first-instance cases (excluding special procedure cases and third-party revocation of judgment cases), 1,817 second-instance cases, and 1,538 initial enforcement cases.

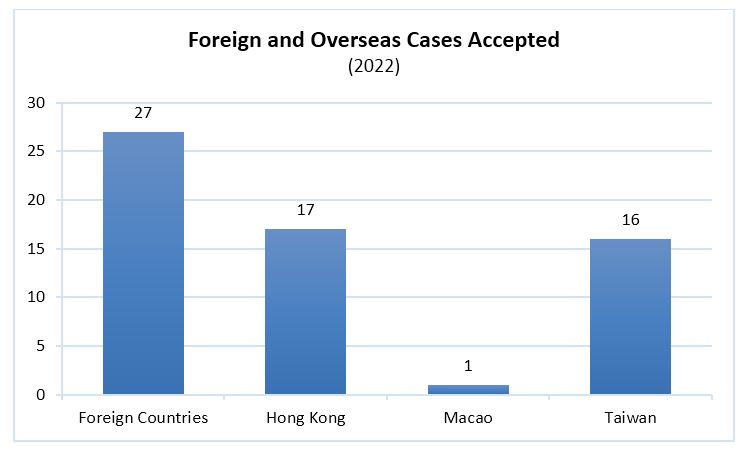

In 2022, the Court accepted 58 cases involving parties from foreign countries, Hong Kong, Macao, and Taiwan, accounting for 0.67% of the total number accepted. Specifically, there were 27 foreign cases[ii], 17 Hong Kong cases[iii], 1 Macao case, and 16 Taiwan cases[iv].

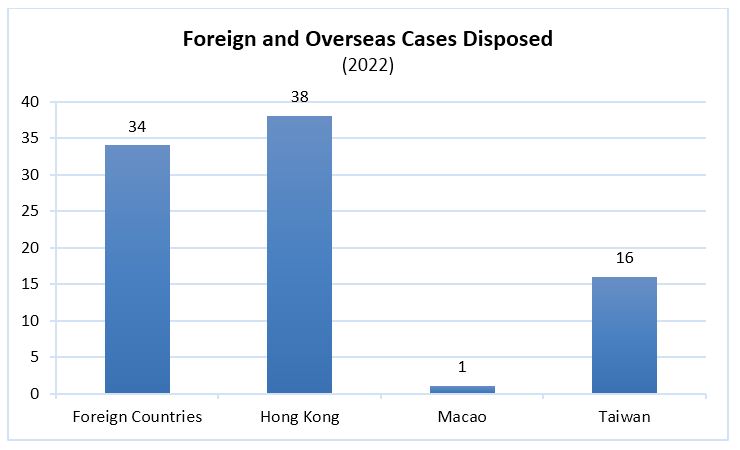

Within the year, the Court disposed of 85 cases involving parties from foreign countries, Hong Kong, Macao, and Taiwan, or 146.55% of the number accepted. This total consisted of 34 foreign cases[v], 38 Hong Kong cases[vi], 1 Macao case, and 16 Taiwan cases[vii].

2. Causes of Action

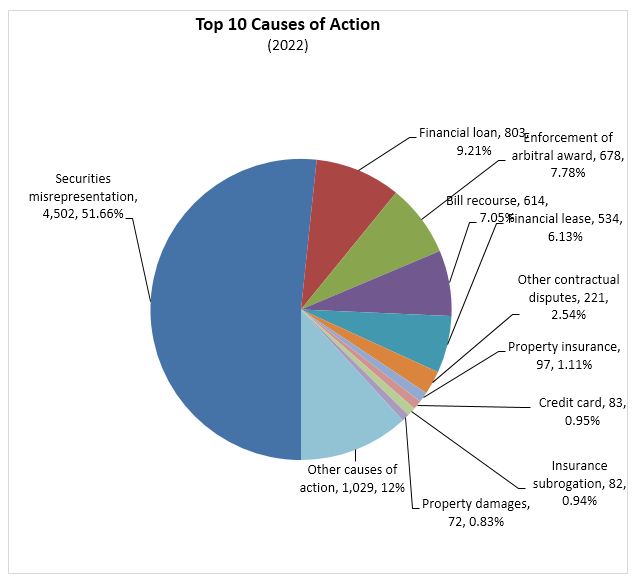

In 2022, the Court has accepted all types of financial cases; the top three causes of action were:

· Securities misrepresentation: 4,502 cases[viii] or 51.66% of the total;

· Dispute over financial loan agreement: 803 cases or 9.21% of the total;

· Enforcement of arbitral awards: 678 cases or 7.78% of the total.

The next top seven causes of action accounted for 1,703 cases, or 19.54% of the total, including 614 for disputes over bill recourse (7.05%); 534 for disputes over financial leasing contracts (6.13%); 221 for other contractual disputes (2.54%); 97 for property insurance disputes (1.11%); 83 for credit card disputes (0.95%); 82 on subrogation in insurance policies (0.94%); 72 for disputes over property damages (0.83%).

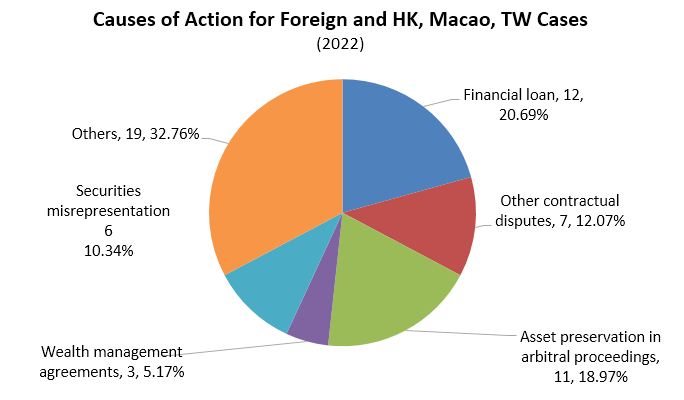

Foreign and Hong Kong, Macao, and Taiwan-related cases are also varied. The top five causes of action were: dispute over financial loan agreement (12 cases, 20.69% of the foreign and Hong Kong, Macao, and Taiwan-related cases accepted); asset preservation for arbitral proceedings (11 cases, 18.97%); other contractual disputes (7 cases, 12.07%); securities misrepresentation (6 cases, 10.34%); dispute over wealth management agreements (3 cases, 5.17%); and other causes of action (19 cases, 32.76%).

(3) Financial Sectors Involved

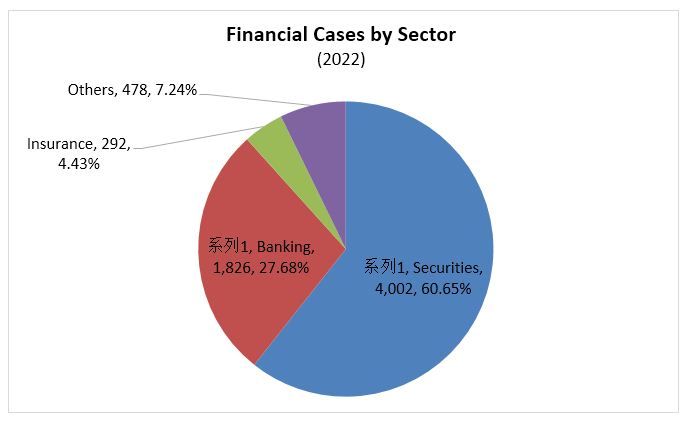

Of all the financial cases accepted by the Court in 2022[ix], securities cases accounted for the majority at 4,002 cases (60.65% of total); followed by banking cases (1,826, 27.68%); insurance cases (292, 4.43%); and cases involving other financial sectors (478, 7.24%).

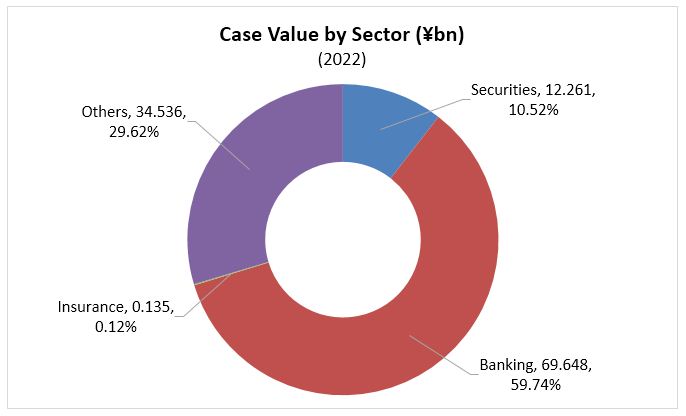

In 2022, the total value of the cases accepted by the Court amounted to RMB178.821 billion (RMB116.58 billion excluding enforcement cases). Banking cases represented the largest share of this total, at RMB69.648 billion and 59.74%, followed by securities cases (RMB12.261 billion, 10.52%), insurance cases (RMB0.135 billion, 0.12%), and other cases (RMB34.536 billion, 29.62%).

II. Conduct and Effectiveness of Financial Trials

1. Improving case handling, safeguarding fairness and justice, and highlighting the effectiveness of the financial justice system

Through lawful and appropriate handling of a broad range of financial disputes, the Court sought to create a fair, efficient, predictable, and law-based business environment, establish the “Chinese standards” and “Shanghai rules” for resolving financial disputes, and enhance the authority and influence of Shanghai’s financial justice system.

First, the Court has been pursuing high-profile cases to underscore the guidance role of financial adjudication rules. The Court disposed of a number of major, complex, and novel financial cases, such as the first securities-related tort case in China that paid out compensatory civil damages in priority, the first securities market manipulation case involving NEEQ (i.e., the New Third Board), the first administrative litigation case to be tried by the new delisting rules, and the first case that a lead underwriter in the interbank bond market was held liable for tort arising from conflict of interest. Of the cases handled by the Court, 14 were named among the Top 10 Cases (and Top 10 Shortlisted Cases) of 2022 for Advancing the Rule of Law in the New Era, the Top 10 Cases of the People’s Courts, the Top 10 Commercial Court Cases Nationwide, the Top 10 Financial and Commercial Cases of Shanghai Courts, and the Reference Cases of the Shanghai High People’s Court. The Court also published the Leading Cases of Shanghai Financial Court 2021, the Top 10 Leading Cases in the Protection of Securities and Futures Investors, and the Report on the Trials at the Shanghai Financial Court (2018-2021), providing clear and consistent guidelines to financial market participants on how financial rules and regulations are applied.

Second, the Court has introduced additional innovations to the trial of financial cases for greater judicial efficiency and effectiveness. The Court boosted the efficiency gains from the separation between complicated cases and simple ones, updated the Implementing Rules of Shanghai Financial Court for Promoting the Speedy Trial of Simple Cases (Trial), closely kept up with the latest amendments to laws and industry developments, and further optimized the allocation of financial trial resources. The Court made sweeping improvements to the model judgment mechanism for securities disputes, including by updating the second iteration of the Provisions on the Model Judgment Mechanism for Securities-related Disputes (Trial), drafted the Provisions of Shanghai Financial Court on the Administration of the Roster of Loss Evaluation Firms (Trial), and improved how parallel cases are tried as a group. Furthermore, the Court also established specific trial rules for financial bankruptcy cases, disposed of Shanghai’s first case on the bankruptcy and liquidation of a local financial organization, and compiled the Handbook of Trial Tools for Financial Bankruptcy Cases to facilitate the orderly exit of financial institutions from the relevant market.

Third, the Court has been improving the trial of overseas-related cases to expand the global influence of China’s financial justice system. The Court actively exercised its jurisdiction over overseas-related financial cases, continued to promote its Model Clauses for the Resolution and Governing Law of Disputes over Overseas-Related Financial Transactions, and published the Q&As on the Common Jurisdictional Topics in the Litigation of Overseas-Related Civil and Commercial Cases to help China’s judicial system tackle more benchmark cases involving overseas-related financial disputes. Such financial disputes are resolved at ever-greater efficiency, as exemplified by the successful mediation of a cross-border letter of credit fraud case involving conflict of jurisdiction, a USD100 million dispute over surety agreement involving three jurisdictions in two countries, and other major overseas financial cases, markedly improving the international appeal of Shanghai as a center for resovling financial disputes. For greater global visibility, the Court has provided an online interactive tour of its programs to the 109 foreign judges from 22 countries who were enrolled in the seminar offered by the National Judges College. The Court also released, on international legal research platforms including Wolters Kluwer, its third collection of selected judgments in both Chinese and English, which received 1.54 million search hits and over 18,000 downloads and citations. These efforts have helped to promote China’s judicial innovations and influence in the handling of financial cases.

2. Supporting national initiatives and priorities and providing stronger judicial services for the financial market

The Court was fully committed to implementing China’s new development philosophy—with particular focus on aligning the financial industry with the real economy, preventing financial risks, and promoting financial reforms—to support the national strategies for the financial industry and help build Shanghai into a more robust international financial center.

First, the Court has been improving the judicial support for the key national initiatives. To support the market-wide transition to the registration-based IPO system, the Court accepted the first securities fraud case in China involving a company listed on the Sci-Tech Innovation Board, highlighting the guidance effect of financial trials on financial activities and helping create a more orderly financial market. In supporting financial reforms and innovations in Pudong, the Court released the Rules on Financial Markets Test Case Scheme (Trial) and heard the first test case. The mechanics of this scheme were included in the Provisions on Green Finance in the Pudong New Area and the opinions of the Supreme People’s Court on judicial support. The Court also sought to promote the high-quality integrated development of the Yangtze River Delta (“YRD”) region by putting into action the Agreement on Regional Judicial Cooperation in the Yangtze River Delta on Financial Matters, holding the inaugural Yangtze River Delta Financial Justice Forum, hosting the Yangtze River Delta Chief Financial Judge Forum for the fifth straight year, and releasing the first collection of leading financial judgments for YRD. Notably, two of its cases and programs were selected among the leading cases and programs of Shanghai-based courts in supporting the Yangtze River Economic Belt and the integrated development of the YRD, showcasing how the financial justice system can boost national strategies and priorities.

Second, the Court has through its judicial functions helped orient the financial sector with the real economy. Responding to the needs for alternative dispute resolution (ADR) approaches, the Court has been promoting mediation as a means of settling financial cases—with eight financial institutions indicating a general consent to pre-trial mediation—and was the first to propose to the Shanghai Stock Exchange, then helped complete, the inclusion of ADR provisions in its listing rules with regard to securities disputes. In 2022, the Court successfully mediated 110 cases, with a value totaling RMB2.273 billion, ahead of trial, significantly reducing the cost of resolving financial disputes. Committed to good faith and civilized enforcement, during the pandemic the Court set up expedited enforcement channels and prioritized the proceeds toward public welfare programs and micro, small, and medium-sized enterprises. In addition, by permitting certain flexibility in the payment of the remaining balance and combining on-site viewing with online live streaming, the Court has helped maximize the success rate and proceeds of auctions, helping businesses get back on their feet as quickly as possible.

Third, the Court has been contributing to the prevention of financial market risks through judicial means. As an innovation of judicial measures for risk control, the Court has made the report on the prevention of legal risks in financial disputes an annual publication. Thus far it has completed the Report on Preventing Legal Risks of Bond Disputes and released the Report on Preventing Legal Risks of Disputes in the Private Fund Industry, which is mentioned in the work report of the Supreme People’s Court delivered at the Two Sessions. The Court has been working to find effective ways of coordinating and synergizing financial justice with financial regulation to increase the breadth, depth, and level of judicial engagement in comprehensive financial governance. The Court has instituted more delineated rules on risk screening and mitigation to ensure the identification and reporting of major cases, the regular screening of potential public complaints and proposals, and the multi-modal prevention, mediation, and resolution of issues and disputes, with a view to ensuring systemic risks do not arise. Moreover, the Court has improved the utility of judicial recommendations, with many of them adopted by organizations such as the Shanghai Stock Exchange and the Shanghai Office of the China Banking and Insurance Regulatory Commission, and which have informed higher-level decision-making, improved the functions of government regulation, and provided reference for the risk control programs of financial institutions.

3. Adhere to the supremacy of the people, meeting the needs of the people and serving public interest through new judicial measures

Staying true to its people-centric philosophy, the Court has made it easier for financial consumers to protect their interest and financial justice more accessible and effective, such that every citizen is given fair and impartial treatment in every court case.

First, the Court has been integrating its judicial services to offer comprehensive protection to retail investors. The Court has established the first investor education center within the Chinese court system, through which it provides regular educational services to securities investors such as promoting leading cases and legal awareness and disclosing investment risks. The Court has also set up China’s first comprehensive judicial protection platform for investors, which combines the mechanics of the mass and innovative litigation practices and the lessons from securities-related trials, as well as smart recognition, automated verification, big data, and cloud computing technologies and the smart features of the in-house Securities Investor Protection Chamber, to provide investors with more efficient litigation services and a more transparent and visual explanation of the steps they can take to protect their interest.

Second, the Court has been advancing the reform of enforcement actions to make justice attainable. By providing judicial assistance in the sale of stocks through block orders, the Court helped sell RMB8.974 billion worth of stocks through the Judicial Assistance Execution Platform, achieving a higher auction success rate than any other court in Shanghai despite the challenges created by the pandemic. With another over RMB20.0 billion of proceeds obtained from enforceable assets, the Court has effectively protected the interest of the successful parties. Additionally, the Court has improved the non-litigation enforcement of financial administrative penalties. In particular, it has disposed of its first non-litigation administrative enforcement case and created a joint review framework with the regulatory authorities to help them combat and deter noncompliant financial activities. To transform the experiences from enforcement reforms into institutional improvements, the Court developed the Integrated Asset Execution Management System which has since been incorporated into the municipal enforcement system for city-wide use, thereby promoting greater standardization, professionalism, and transparency in enforcement actions. Lastly, the Court was deeply engaged in the drafting of the Provisions of the Supreme People’s Court on Issues Concerning the Enforcement of Securities to contribute its experiences and innovations.

Third, the Court has introduced more specific measures to make court services more convenient and effective for the public. Aside from additional improvements to its litigation service center, the Court enhanced its 12368 service hotline and its online case filing review service so that the two have better defined functions while also working better together, and set up a Q&A desk for post-judgment questions. Altogether, the Court processed 8,315 hotline and online inquiries with a 99.88% satisfaction rate. The Court has made the filing of mass dispute cases more accessible and enhanced the pre-filing consultation mechanism for mass securities dispute cases, enabling it to accept more than ten securities misrepresentation cases in an orderly manner. To ensure access to litigation services, the Court promoted its online case acceptance, pre-trial mediation, trial, and enforcement services, allowing the parties to resolve their disputes without leaving their homes. Also to address a longstanding issue faced by the parties, the Court improved the refund procedures for legal costs , lay down the Rules of Shanghai Financial Court on the Refund of Legal Costsand Transfer forEnforcementand developed a system for refund of Legal Costs. Furthermore, the Court has expanded its outreach channels, publishing 279 articles on its WeChat account and garnering 2.172 million views from its WeChat and Weibo postings, helping create a more legally literate and law-abiding citizenship.

Responding to the new requirements for financial trials in the new era, the Court will closely adhere to the criteria for financial justice in this era and take collaborative, innovative, and pioneering steps to achieve its own high-quality growth, so as to support the national strategies for the financial industry, help build Shanghai into a stronger international financial center, meet the diverse needs of the public for financial justice, and provide greater judicial support for China’s modernization program.

[i]Excluding resumed enforcement cases, asset preservation cases, and cases where pre-trial mediation leads to the issuance of a civil mediation paper or the judicial confirmation of a mediation agreement. In the histogram “Cases Accepted and Disposed (2018/08/20 - 2022/12/31),”figures from 2018 to 2020 include the aforementioned four types of cases;figures from 2021 to 2022 do not, as per the updated judicial statistical rules of the Supreme People’s Court.

[ii] Including 2 enforcement cases, 2 cases additionally involving Hong Kong, and 1 case additionally involving Taiwan.

[iii] Including 3 enforcement cases and 2 cases additionally involving foreign parties.

[iv] Including 1 case additionally involving foreign parties.

[v] Including 2 enforcement cases, 3 cases additionally involving Hong Kong, and 1 case additionally involving Taiwan.

[vi] Including 3 enforcement cases and 3 cases additionally involving foreign parties.

[vii] Including 1 enforcement case and 1 case additionally involving foreign parties.

[viii] Including enforcement cases of securities misrepresentation dispute.

[ix] Excluding enforcement cases.

Copyright (c) 2018 Shanghai Financial Court China Disclaimer