In 2024 under the guidance of the Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era, the Shanghai Financial Court (“Court”) put the Xi Jinping Thought on the Rule of Law into practice by leveraging the functions of financial adjudication. To become a world-class financial court, it has upheld high standards to achieve high-quality growth at an accelerated pace. The Court is providing Chinese and foreign financial markets entities with fair, efficient, expedient and predictable financial judicial services. Through its professional, international, and digital services, the Court is improving the effectiveness of the financial justice system to help build Shanghai into an international financial center.

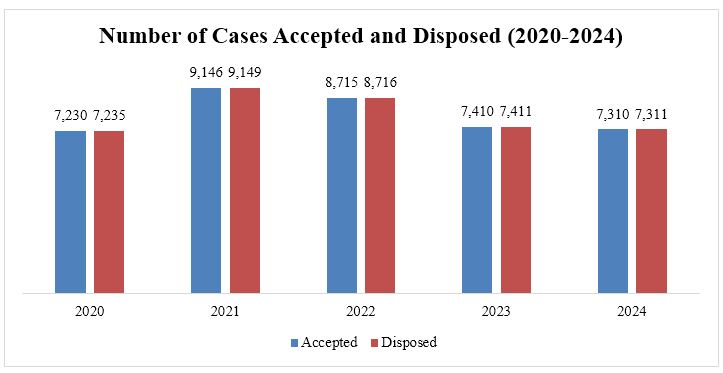

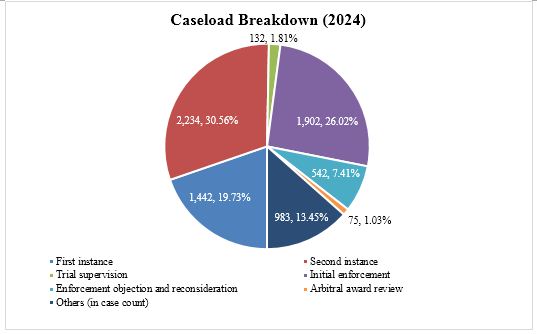

The Court accepted 7,310 financial cases in 2024, down 1.35% year-on-year, comprising 1,442 first-instance cases, 2,234 second-instance cases, and 1,902 initial enforcement cases. The total value in dispute amounted to RMB 215.726 billion.

The Court disposed of 7,311 financial cases, composed of 1,480 first-instance cases, 2,221 second-instance cases, and 1,906 initial enforcement cases. Total amount enforced was ¥22.318 billion, up 3.2% year-on-year.

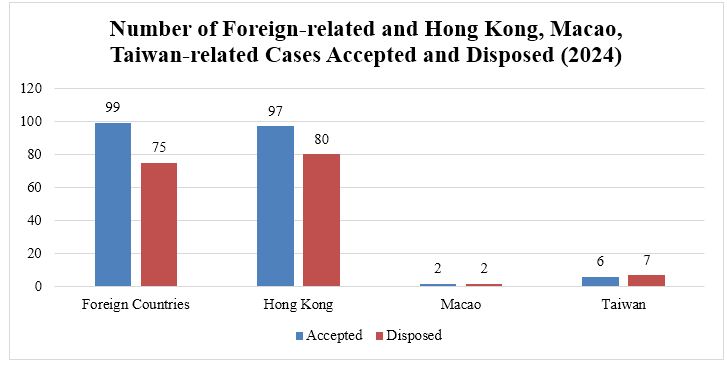

The number of cases with foreign, Hong Kong, Macao, and Taiwan elements, continued to grow rapidly. In 2024, the number of such cases surged by 136.14% year-on-year, reaching to 196, consisting of 99 foreign-related cases (6 also relate to Hong Kong and 2 to Taiwan), 97 Hong Kong-related cases (6 are also foreign-related), 2 Macao-related cases, and 6 Taiwan-related cases (2 are also foreign-related). Total value in dispute was ¥33.1 billion, involving parties from the United States, the United Kingdom, Japan, Australia, Canada, South Korea, the Netherlands, Spain, New Zealand, Cayman Islands and the British Virgin Islands.

In 2024, the Court disposed of 162 cases involving foreign, Hong Kong, Macao, and Taiwan parties, marking a 76.09 % increase year-on-year. This total consists of 75 foreign-related cases (2 also relate to Hong Kong), 80 Hong Kong-related cases (2 are also foreign-related), 2 Macao-related cases, and 7 Taiwan-related cases.

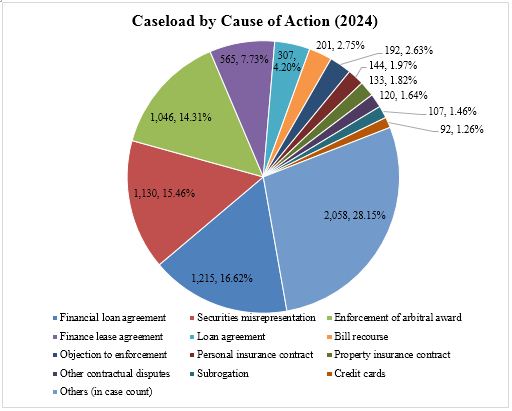

The Court’s caseload in 2024 covered all types of financial matters; the top three causes of action were:

· Dispute over financial loan agreement: 1,215 cases, a 21.7% increase from the year before to overtake securities misrepresentation as the top cause of action, accounting for 16.62% of all the cases accepted and involving a value in dispute of ¥110.944 billion;

· Securities misrepresentation[1]: 1,130 cases or 15.46% of the total, involving a value in dispute of ¥949 million;

· Enforcement of arbitral awards: 1,064 cases or 14.56% of the total, involving a value in dispute of ¥7.809 billion.

The next leading causes of action consisted of 1,861 cases, or 25.46% of the total, comprising 565 over finance lease agreements (¥7.976 billion in dispute), 307 over loan agreements (¥4.058 billion), 201 over bill recourse (¥40,043,500), 192 over objection to enforcement (¥5.607 billion), 144 over personal insurance contracts (¥11,372,800), 133 over property insurance contracts (¥440 million), 120 over other contractual disputes (¥20.626 billion), 107 over subrogation (¥31.98 million), and 92 over credit cards (¥4,014,700).

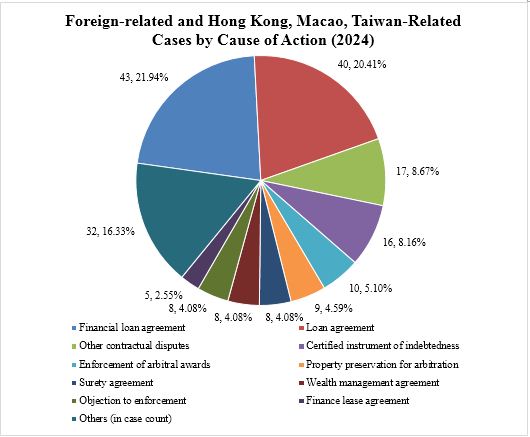

Foreign-related and Hong Kong, Macao, and Taiwan-related cases also covered a wide range of causes of action, including: 43 cases or 21.94% over financial loan agreements, 40 cases (20.41%) over loan agreements, 17 cases (8.67%) over other contractual disputes, 16 cases (8.16%) over certified instruments of indebtedness, 10 cases (5.10%) over enforcement of arbitral awards, 9 cases (4.59%) over property preservation in arbitration proceedings, 8 cases each (4.08% each) over surety agreements, wealth management agreements, and objection to enforcement, 5 cases (2.55%) over finance lease agreements, and 32 cases (16.33%) for other causes of action.

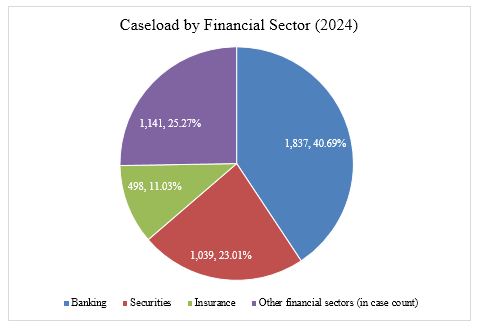

Of all the cases accepted by the Court in 2024[2], banking cases made up the majority at 1,837 cases or 40.69% of the total, with a value in dispute of ¥49.663 billion; followed by securities cases (1,039, 23.01%, and ¥5.029 billion), insurance cases (498, 11.03%, and ¥1.106 billion), and cases involving other financial sectors (1,141, 25.27%, and ¥41.271 billion).

In 2024, the Court continued to play the exemplary and leading role as the first financial specialized court in China. Through rule-making and institutional innovations, it has been raising the effectiveness of the financial justice system, meeting the new needs and expectations of the public for financial justice, and, always with its political mandates in mind, helping Shanghai become more competitive and influential as an international financial center. These efforts allowed the Court to achieve results in all areas.

1. Boosting market confidence and the five key areas of finance

Technology finance. As a specialized court with jurisdiction over all disputes relating to the STAR Market of the Shanghai Stock Exchange, the Court has disposed of a series of representative cases, including the first case of offering fraud on the STAR Market. In particular, the Court has established an interprovincial collaborative mechanism for the judicial and regulatory resolution of disputes in the Yangtze River Delta region, allowing STAR-listed companies to clear legacy litigations and retail investors to receive restitutions in a prompt manner. The Court made a compilation of its leading cases and institutional innovations in support of the reform of the STAR Market, which received coverage by national media outlets including CCTV and the China News Service.

Digital finance. The Court closed several novel cases concerning the obligations of E-platform operators, which were selected into Annual Cases of Chinese Courts and Typical Cases of Shanghai Courts in Serving the Development of Digital Economy. The Court issued judicial suggestions regarding employer’s liability insurance for food delivery companies, encouraging the insurance industry to develop products tailored to this new employment model to better protect the interest of delivery riders and couriers.

Green finance. The Court successfully resolved a number of complex and high-profile cases, including the first securities dispute involving soil remediation stock on the STAR Market and a finance lease dispute concerning a 50 MW wind farm. Through its judgments, it is guiding financial institutions to optimize green financial services and ensuring the sustainable development of eco-friendly enterprises.

Inclusive finance. The Court released both representative cases on investor protection and risk tips which were shared by official government WeChat accounts such as “Shanghai News Release,” guiding the public towards rational investment. It also produced reference reports on financing for micro-, small-, and medium-sized enterprises (MSMEs) and investing in rural areas, and published the Legal Risk Prevention Report for Financial Leasing Disputes as well as representative cases.

Finance for aged care. The Court accepted over 1,200 financial cases involving seniors aged 60 and above. It introduced volunteer services to provide convenience services and issued judicial suggestions addressing insurers’ denial of claims filed by workers exceeding the statutory retirement age, leading to the release of recommended operating protocols for the Shanghai insurance industry, effectively addressing the issue of “unequal compensation for equal work.”

2. Creating a rule of law-based business environment to help Shanghai become an international hub for financial justice

Identifying the potential legal risks of financial opening-up. Following the inclusion of the financial markets test case scheme in the Regulation on Building Shanghai into an International Financial Center, the Court accepted the second test case. The case is part of a stress test of the legal risks of electronically issuing bonds in the Shanghai Free-Trade Zone for offshore investors. The case will contribute to the internationalization of Renminbi and boost Shanghai as a global investment platform.

Creating a Financial Judicial Innovation Zone in the Lingang New Area. The Court held an event in Lingang to celebrate a compilation of its top cases written in both Chinese and English, stabilizing the expectations of Chinese and foreign parties with regard to the rules of adjudication. The Court continued to support the one-stop dispute resolution center in Lingang, conducting a successful on-site mediation of a ¥100 million dispute over a financial loan agreement, and providing relief to a Lingang-based high-tech company.

Supporting Shanghai’s bid as an international hub for commercial arbitration. The Court’s White Paper on Judicial Review of Financial Arbitration and accompanying case synopsis were widely applauded by Shanghai-based arbitration institutions. As a result of the Court’s continuing judicial supervision of arbitration decisions, one case involving the recognition and enforcement of foreign arbitral awards was collected into the Case Law on UNCITRAL Texts.

3. Promoting the coordinated governance of financial markets to prevent and defuse financial risks

Accelerating market clearing through bankruptcy and reorganization cases. The Court accepted China’s first case for the bankruptcy liquidation of an insurance company and the first case for the compulsory liquidation and conversion to bankruptcy of a financial institution. To facilitate bankruptcy cases involving financial institutions, it has bolstered government agency-court coordination, and set up a compensation fund to encourage administrators to lawfully fulfill their duties, thereby improving the outcome of its rulings.

Supporting financial administrative organs to perform their duties in accordance with the law. To expand its circle of partnering agencies for administering financial justice and regulation and for preventing and mitigating financial risks, the Court has established a coordination framework involving the public security, procuratorial, judicial, and financial regulatory authorities as well as self-regulatory organizations. Exercising its power to supersede the jurisdiction of lower courts, the Court also heard financial administrative cases relating to post-loan management at banks, urging them to strengthen supervision on the use of loans and prevent credit risk.

Helping maintain safe and efficient financial infrastructures. The Court created social governance scenarios based on cases involving performance of duties by financial infrastructures. After analyzing a large volume of judicial data to identify the potential risks in financial self-regulation, the Court sent judicial suggestions to the Shanghai Commercial Paper Exchange that resulted in an optimization of the latter’s electronic draft system.

1. Ensuring alignment of the political, social, and legal effects of rulings for positive outcomes in public-related cases

Offering optimal legal solutions to retail investors seeking to protect their interest. The Court continued to improve the representative action mechanism for resolving securities disputes. Notably, the case of Essence Information Technology, which is China’s first securities representative action resolved by settlement, was selected by the China Securities Regulatory Commission (CSRC) as one of the top ten cases in the area of investor protection. The model judgment system also saw increasing use, enabling securities investors in parallel cases to receive damages in 18 days on average and in 1 week at the quickest.

Addressing the new challenges faced by aggrieved financial investors. The Court issued the first judgment in China that ordered a private fund administrator to pay compensation for failing to make fair distributions, and, in an action filed against a collective investment trust by one of its investors, defined the boundaries of the investor’s right to know. These cases involved ruling on new rights to precisely delineate their limits, which help regulate the conduct of financial institutions and protect financial investors.

Bringing trial services to people’s doorsteps. The Court continued to invest in its circuit trial program, successfully resolving a number of cases with direct consequences on people’s wellbeing, such as one involving critical illness insurance payout for ground-glass opacification and another involving payment for car damage after a multi-car collision. These cases are heard right in the corresponding communities, with local officials and residents invited to attend. This not only creates opportunity for public legal education, but also helps improve local governance, integrates court hearing with legal outreach, and enables people to benefit from judicial services.

2. Carrying out enforcement actions in the best interest of the parties

Pioneering new enforcement arrangements. The Court invented a new model for disposing of high-value, non-homogeneous properties, consisting of bulk online auction listing, wide-selection bidding, and flexible disposal methods. New functionalities were also added to the online auction system which greatly increased the likelihood of a successful sale. At the same time, by working more closely with financial infrastructures, enforcement against shares listed on the Beijing, Shanghai, and Shenzhen stock markets can now be completed online. Further procedural efficiency in enforcement actions is provided by the dedicated internet line established with the Shanghai Clearing House for judicial assistance purposes.

Resolving major and high-profile cases. The Court successfully auctioned off the prospecting right of a 45-square kilometer mine for ¥1,347 million, disposed of a cluster of luxury houses for over ¥2.3 billion, and recovered more than ¥1.0 billion in cases involving local government debts. With the combined effort of primary, intermediate, and high courts, eviction at a large hotel, covering more than 70,000 square meters of space in some 40 floors, was successfully completed and recognized by the Supreme People’s Court as a model case for cross-jurisdictional enforcement.

Clearing obstacles. A pre-enforcement oversight procedure was established for low-value arbitration cases, leading to the disposal of close to 600 enforcement cases that helped small and medium financial institutions recover their loans. This success was reported in the “Enforcement News” periodical of the Supreme People’s Court. The Court was also deeply engaged in resolving long-standing enforcement cases, leading to the closure of 518 that represented a significant portion of the backlog.

3. Raising the awareness and respect for financial judicial services

Boosting promotion of leading cases. The Court reported and published more than 70 leading judgments throughout the year; 20 were covered by the Xinhua News Agency, the People’s Daily, and CCTV for setting new rules. These cases help participants of the financial market to operate compliantly and raise the influence and authority of China’s financial justice system.

Developing new educational products. The Court has tapped into many new educational formats—such as short dramas, and the “Xiaoxiao Speaks about Insurance” short videos that focus on day-to-day scenarios such as using a car rental service and filing claims for osteoporosis—to explain the law to the public in a manner that is both educational and entertaining, raising the general level of legal awareness.

Showcasing the administration of financial justice in China. The Court launched a special column, “Rule of Law in Foreign-Related Financial Transactions,” to explain the principles of financial justice in China. The Court has received nearly 100 foreign guests and increased engagement, including mutual visits, with the courts at other international financial centers, in order to present the history and outlook of financial justice in China and promote Shanghai as a preferred location for resolving international financial disputes.

1. Creating exemplary cases to achieve greater uniformity in the application of law

Empowering the Court’s president and presiding judges as role models. To ensure the “key minority” fulfill their supervisory functions, the Court has instituted more rigorous review of its judgments. The president and presiding judges oversaw the disposal of a number of major and complex cases, including China’s first securities misrepresentation case involving an employee stock ownership plan. As a result, five cases, seven judgments, and four court hearings were included in the “Top 100 Cases of Shanghai Courts,” “Exemplary Judgments,” and “Model Court Hearings” lists. The Court stood out as the only primary- or intermediate-level court nationwide to have three judgments included in the country’s top 100 judgments list.

Contributing to legal database and platform. The Court frequently contributes to the People’s Courts Case Database and the Judicial Q&A Platform to promote the uniform application of adjudication standards. During the year, 14 of its cases were included in the Database, and the Court achieved a high ranking among Shanghai-based courts in the number of legal answers recognized as high-quality answers.

Promoting exchanges across judicial levels. The Court made greater use of its power to supersede the jurisdiction of lower courts, with one such elevated case named among the top ten financial trials of Shanghai courts and another recognized as a leading administrative trial of Shanghai courts. Additionally, the Court sent delegates to primary-level courts to hold workshops on financial trials and to discuss the legal challenges they have faced. These exchanges promoted mutual understanding between the two levels of court regarding their financial trial practices, helped clear obstacles, and ensured the effective coordination of workflows.

2. Driving institutional innovation to optimize legal remedies

Participating in collaborative governance of the financial market. The Court continued to promote the “general consent to pre-trial mediation” scheme for financial disputes. Through this scheme, 3,754 disputes were resolved, giving a success rate of 74.6 percent. Throughout the year, six training sessions were organized for the industry’s mediation organizations to help mediators raise their performance. As a result, in 2024, the number of civil first- and second-instance trials fell 21.44 percent and 8.28 percent, respectively, winning the Court recognition as a leading organization in alternative dispute resolution.

Improving linkage between case acceptance, adjudication, and enforcement processes. The Court’s Inter-Divisional Judges Committee conducted holistic assessment of the acceptance, adjudication, and enforcement of cases to ensure conclusive resolution of disputes. The property preservation process was simplified, and the associated fees reduced, for arbitration cases, which has made future enforcement actions easier. Moreover, oversight for the voluntary performance of court judgments was bolstered, leading to a 9.26 percent decrease in initial enforcement cases and demonstrating significant progress in the substantive resolution of disputes.

3. Promoting institutional building to align trial management with judicial principles

Rigorousness. The Court established a “4+1” trial management and data consultation mechanism. Addressing the key aspects of trial management—analyzing trends in accepted, disposed, and pending cases; evaluating trial quality and efficiency metrics; overseeing progress on key cases; and managing the four categories of cases—46 work guidance were created, and 9 trial management rules were revised, promoting more rigorous trials through more rigorous rules.

Efficiency. The Court created a discussion and evaluation process within the adjudication committee for long-standing cases. By together identifying and resolving the root issues, the number of legacy cases fell 47.4 percent year-on-year. The Court also established the Rules on the Management of the Appeal Transfer Process (Trial), cutting the time required for transferring appeal cases by half.

Quality. The Court conducted seven thorough case evaluations and rectification campaigns, implementing immediate and effective corrective actions to ensure that trial quality remains a top priority.

1. Digital empowerment for more effective and efficient casework

Achieving end-to-end supervision of key cases. The Court developed a key case supervision and management system that features automatic identification, accurate labeling, real-time alert, and intelligent supervision functions. This has made the Court one of the leading courts in Shanghai by the percentage of key cases under oversight.

Offering full-process assistance to judges. With internet connections to the judicial data research institute of the Supreme People’s Court, judges can now readily look up litigation-related information of the parties. An AI assistant was launched to offer trial assistance, including search for similar cases and intelligent Q&A, which has boosted the quality and efficiency of financial trials. The Court has submitted 125 application scenarios for digital-assisted case supervision and management, garnering Shanghai’s Outstanding Organization Award for Digital Court Applications.

Achieving full lifecycle management of digital archives. The Court has created a digital archive and resource platform that encompasses file collection, storage, management, and retrieval functions. This platform can produce visual information maps, marking a transition from managing archives to managing data. For this innovation, the Court was awarded the title of “Shanghai’s Model Digital Archive Room.”

2. Digital empowerment for expedient litigation services

Adopting a need-driven approach. The Court has focused on developing litigation service scenarios that address public needs and challenges. One notable example, the “one-click retrieval of certificates of effective judgment for litigated cases,” was among the first application scenarios to be integrated into “Anhutong,” Shanghai’s e-case service platform. This feature makes it easy for parties to check case status and reduces their application burdens. The Court has also developed a key element-based trial assistance model for securities misrepresentation cases. This model can automatically send relevant model judgments and loss assessment reports to investors involved in similar cases to help them assert their rights.

Driving innovations. The Court’s Securities Investor Protection Chamber was put to greater use, winning praise from the Chief Justice of Brunei that it has “set an example for the world to follow.” The Court also upgraded the platform that manages representative actions in securities misrepresentation cases, by adding support for special representative actions and other enhancements. These digital applications for investor protection were featured in the publications of the Supreme People’s Court.

3. Digital empowerment for intelligent and relevant social governance

Strengthening coordinated risk prevention through data sharing. To prevent financial risks, the Court has developed a series of scenarios for the automatic sharing of judicial data. This initiative led to the identification of 325 potential violations, such as disguising loans as finance lease and non-compliant online insurance sales activities, which were reported to competent financial regulators. Five businesses thus identified were added to the list of finance lease companies with abnormal business operations. These results were recognized by the Shanghai Financial Service Office and the CSRC Shanghai regional office.

Using data to inform decisions. The Court actively engaged in financial governance by using judicial data as a weather vane for the financial sector. Reference reports on MSMEs’ financing activities and local government debt-related disputes received comments from key officials at higher government agencies, culminating in an Outstanding Achievement Award for Digital Court Applications awarded to Shanghai-based courts.

In 2025 under the guidance of the Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era and the Xi Jinping Thought on the Rule of Law, the Shanghai Financial Court will implement the directives of the Central Government, the CPC Shanghai Municipal Committee, and the higher courts, and will continue to build itself into a world-class financial court that offers professional, international, and digital services. Building on its financial adjudication mandates, the Court will fulfill its pioneering role as China’s first specialized financial court, in order to help Shanghai become a competitive and influential international financial center and China become a financially robust country.

Copyright (c) 2018 Shanghai Financial Court China Disclaimer